In the grand casino of the global markets, Elon Musk has just placed the ultimate hedge: a billion-dollar bet that the long-term returns on innovation will always outperform the short-term volatility of fear. His personal investment in Tesla is a strategic move to hedge against a market dominated by pessimism.

While many investors are hedging with traditional safe-haven assets like bonds or gold, Musk is proposing a radical new hedge: owning a piece of the future. His thesis is that the most innovative companies, those creating entirely new markets in AI and robotics, are the safest long-term bet of all, because they are creating the very world where future value will reside.

The 8% stock surge suggests that the market is intrigued by this new type of hedge. In a world where traditional safe havens are offering low returns, the idea of “safety through innovation” is a compelling one. Musk’s personal commitment makes Tesla the poster child for this strategy.

This billion-dollar hedge is self-reinforcing. By investing in Tesla, he strengthens its ability to innovate, which in turn makes it a more effective hedge against economic stagnation. He is actively improving the quality of his own hedge.

Ultimately, Elon Musk is challenging the very definition of a safe asset. He is arguing, with a billion dollars, that in an era of rapid technological change, the riskiest thing you can do is bet against the future. The safest bet, he argues, is on the innovators who are building it.

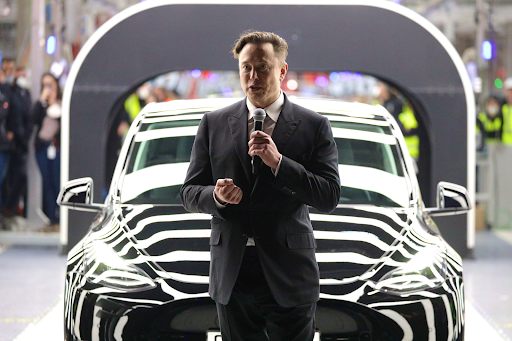

The Ultimate Hedge: Musk Bets a Billion that Innovation Outperforms Fear

15